Step-by-Step Guide

Step 1

PROVIDE BUSINESS INFO

Click on the images to zoom in

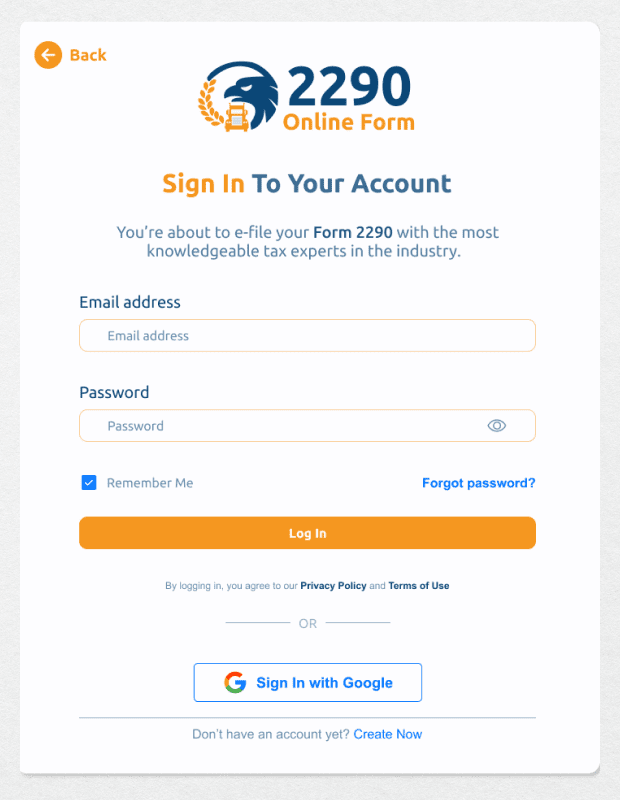

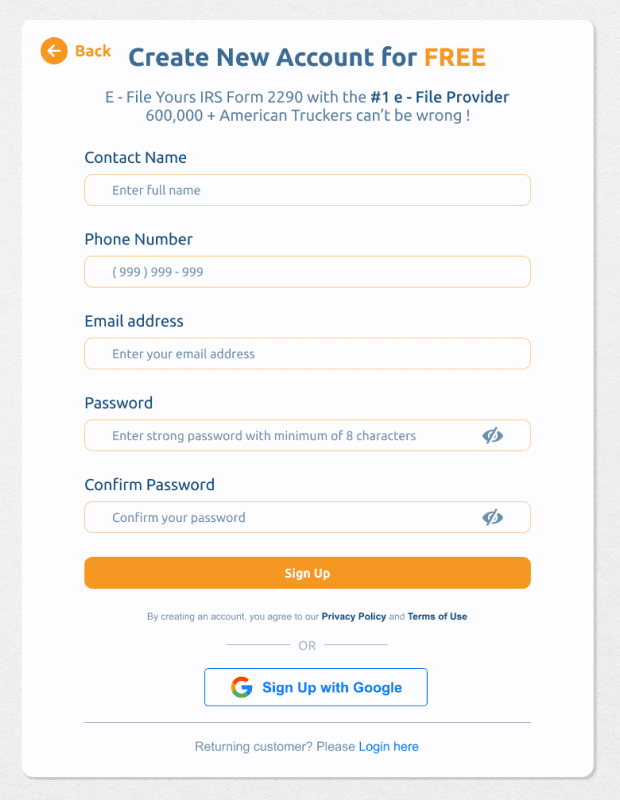

Sign into your account and if you don’t have an account, registration is fast and easy. Register with your name, phone number, email address and create your password. We’ll send you an e-mail to confirm your account. Just find that email, click the link, and log-in with your new credentials.

Click on the images to zoom in

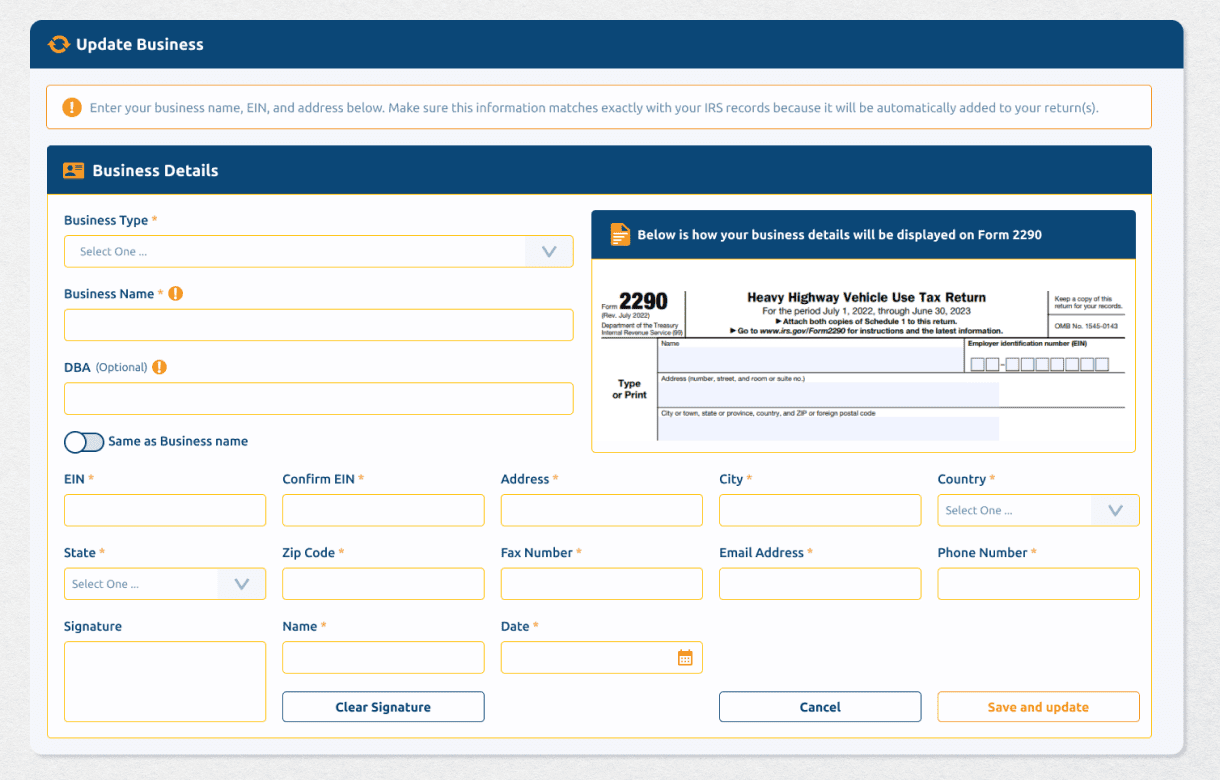

Once you log in, you’ll be directed to all the services we offer. Select the best option for you and you’ll be sent to our smart service form. No more wondering what fields should be left blank and what fields are required. We take out all the guesswork. Once you have added your business, select the year you want to submit your Form 2290. In most cases, you will select the current year option for this year’s taxes. Click the yellow “Next Step” button for step 2.

Click on the images to zoom in

This is the contact information we use to notify you the moment your Form 2290 is approved. Sign at the bottom and click the yellow “Save” button, and your business will now be part of the drop-down menu. This means that every time you log in, you’ll save time on future submissions and amendments.

Step 2

SUBMIT YOUR VEHICLE INFO

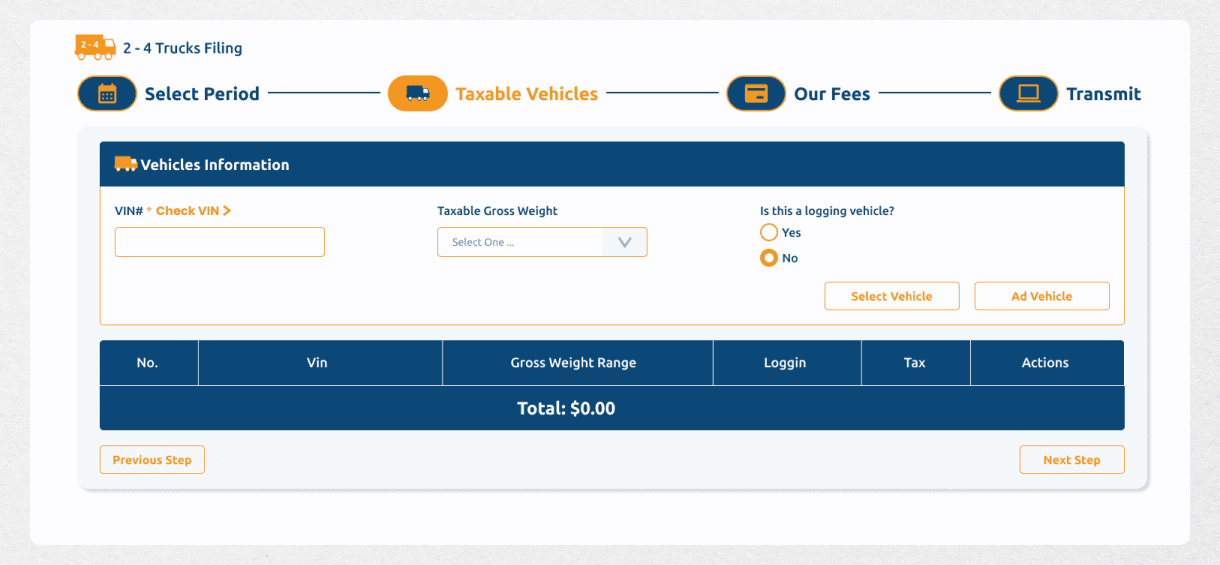

The next step is to provide everything the IRS needs to know about your heavy vehicles. Depending on your filing needs, you may be asked to submit your VIN, and taxable gross weight. If you’re not sure how to calculate your taxable gross weight, check out our FAQs . Also, be sure to check if your heavy vehicle is a suspended vehicle or a logging vehicle as you may qualify to apply for some great discounts that are offered for those types of heavy vehicles. Our smart forms are specifically curated to only ask for the information you need. Complete the form for each of your heavy vehicles. Use our “CHECK VIN” tool, which will check to see if your VIN is already in the National Highway Traffic Safety Administration (NHTSA) records. It is always a good idea to double check your VIN, even if it is cleared by our system. Add as many vehicles as you need, and our smart system will instantly calculate your total tax due. No muss, no fuss.

Click on the images to zoom in

Step 3

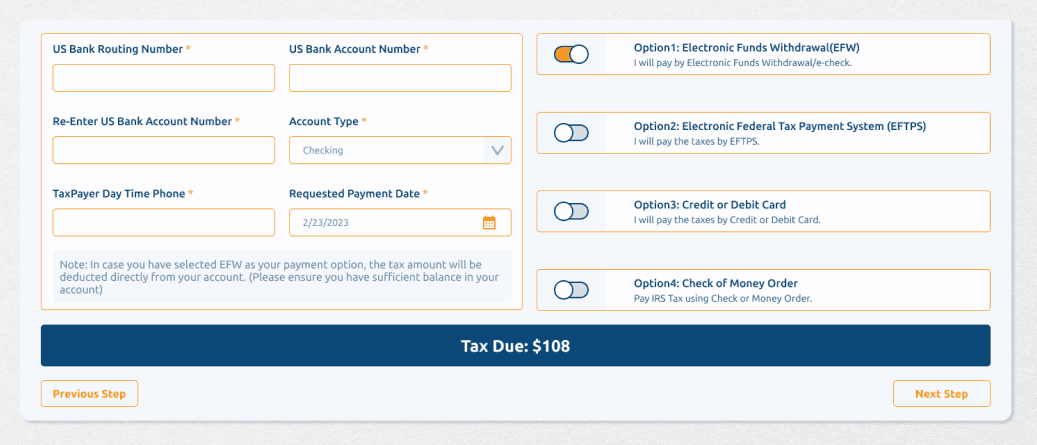

PAY AND FILE WITH IRS

We offer more payment options than any other e-filing provider. We accept all major credit cards and debit cards, and we also allow you to send payment directly to the IRS with a variety of options. Accepted forms of payment include electronic funds withdrawal (EFW), electronic federal tax payment systems (EFTPS), and check or money orders. Select the payment option that works best for you and click the green “NEXT STEP” button on the bottom right. Make sure to do one last check to make sure all the information you entered is correct. Make sure your EIN, VIN, and total number of vehicles entered match your records before clicking “Submit!” Congratulations, you just filled out your annual Form 2290 and your documents have just been submitted to the IRS. Once your Form 2290 is approved, we will send you an email with your stamped Form 2290 Schedule 1 tax form for your records. You can print out a copy to submit to your local department of motor vehicles and get back on the road. Of course, the Form 2290 may not be the only step you need to complete to get your vehicle ready for the road. Check out our sister site, tripfuelpermits.com to register for your vehicle’s fuel permits, commercial permits, IRP (International Registration Plan) permits, IFTA (International Fuel Tax Agreement) permits, and more.

Click on the images to zoom in